5 Popular Personal Finance Apps in 2017

We owe technology and the Internet for making banking and managing our money less painful. Gone are the days when there’s no other option but to wait in line before making a deposit in the bank. What used to be the arduous task of transferring money to someone’s bank account can now be done on your smartphone in the comfort of your home.

Whether you are getting your personal finances in order or strategizing for your next investment, there are a number of apps you can choose from, and they will save you time, money and effort.

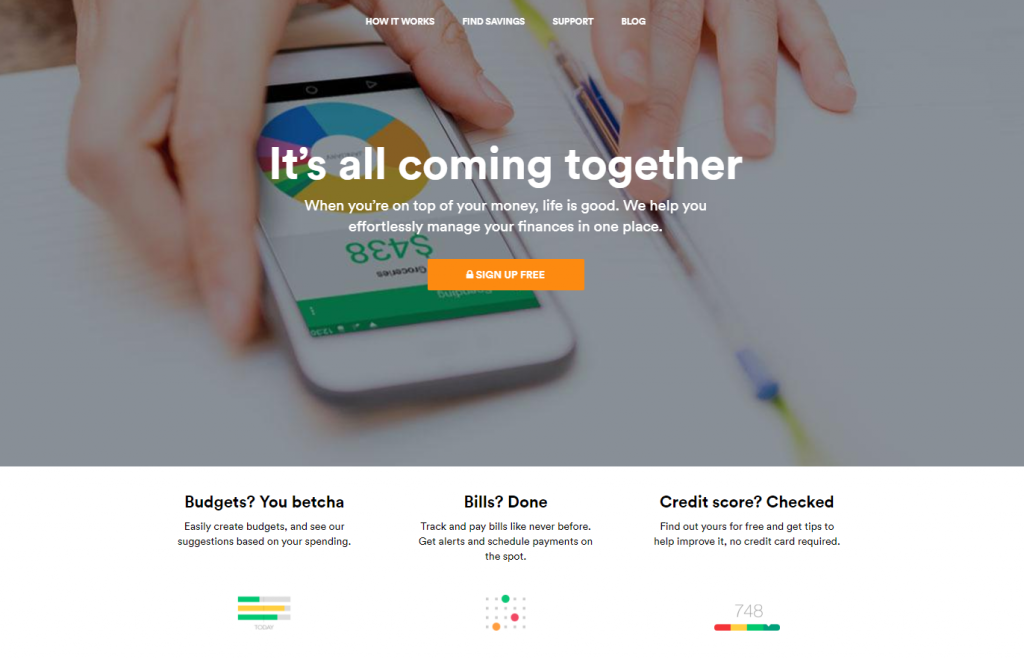

Mint (Android/IOS)

Mint is one of the most widely used personal finance app of our time. The app, developed by Intuit, gives you a consolidated view of all your finances from different bank accounts, credit cards, or even student loans, providing you with a better understanding of where you stand financially.

While tracking your spending, Mint also alerts you when you’re about to go over your budget limit on a particular transaction category (e.g. groceries), informs you of when bills are due, and provide advice on how you can have better control of your spending. New features have now been added, like different tools for paying bills and checking your credit score. Best of all, it’s free.

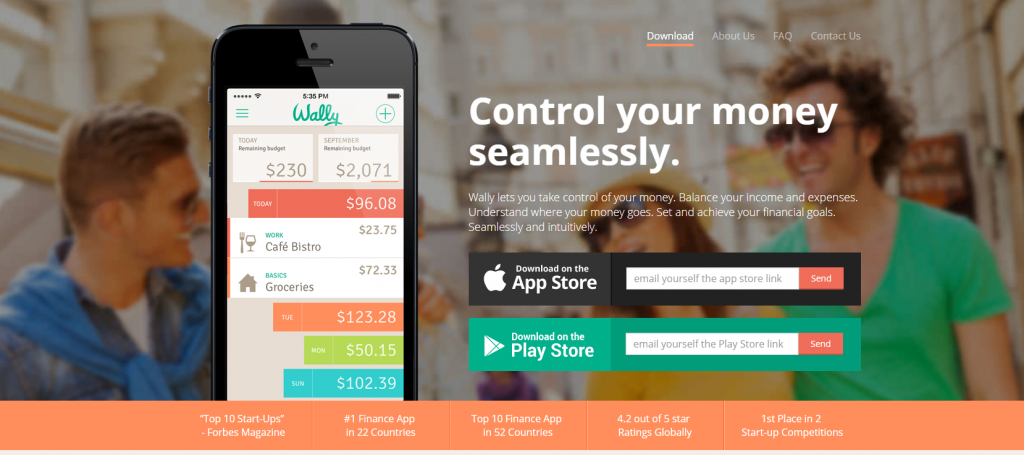

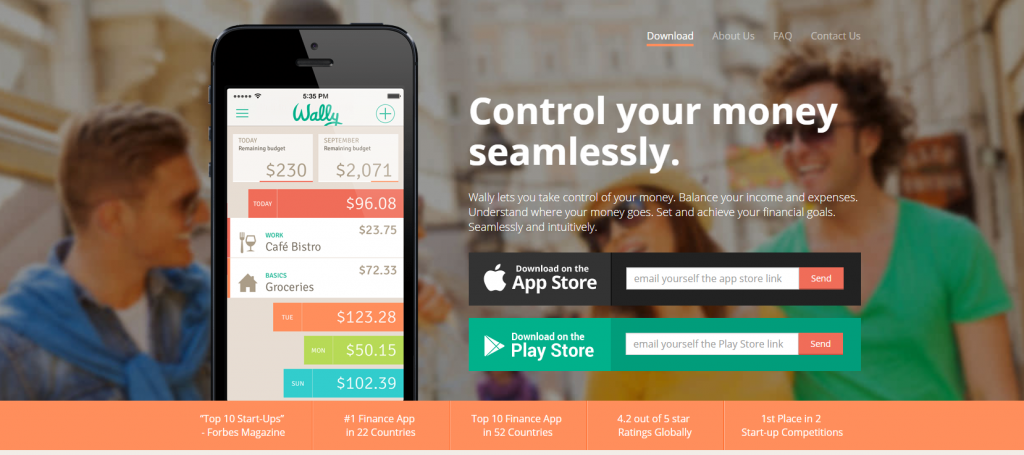

Wally (Android/IOS)

Wally is a free app for those who want to keep all personal expenses organized. The app allows you to view your expenses on a daily, weekly or monthly basis. One of its best features is the receipt-scanning system. Instead of manually logging in all of your expenses for the day, week or month, you can simply take a photo of your receipts and the app will automatically input all the details. It also has a geo-location feature, which, when switched on, will automatically identify the venue your transaction took place.

Digit

While most personal finance apps prioritize money management, Digit is all about saving money. The app analyzes your income and spending patterns, and suggests a small amount of money you can set aside for savings. This amount will be transferred from your checking account to a separate savings account called the “Digit savings” account. Money from this account can be withdrawn, but without interest. This app is perfect for building an emergency fund.

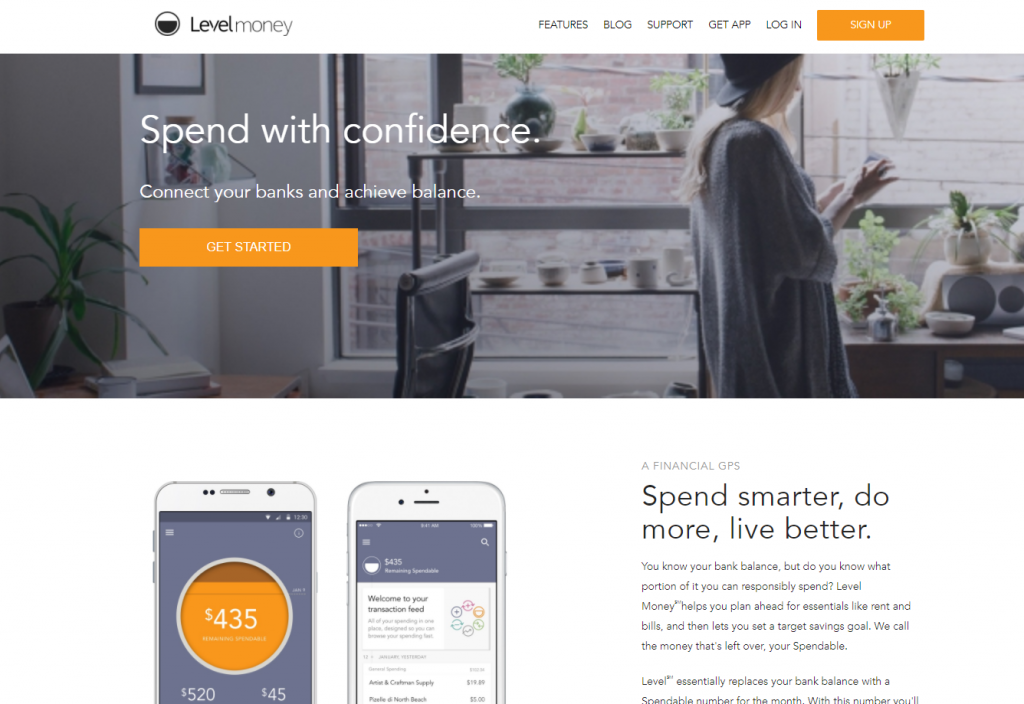

Level Money (Android/IOS)

When connected to a bank account, Level Money automatically calculates your income and bills, and informs you of how much money you’ve spent every month, which it calls “Spendable” money. It also helps you come up with a savings amount every month and deducts this to your monthly budget. You can create a daily spending guide to stay on track of your finances.

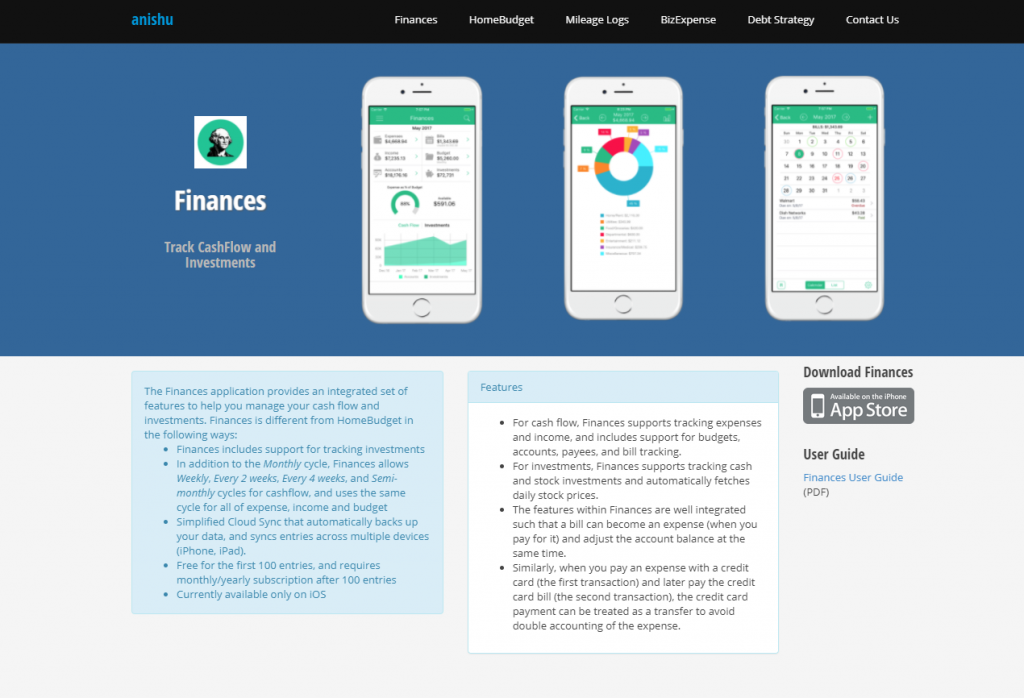

HomeBudget with Sync (IOS)

A unique feature of HomeBudget is the “family sync,” which allows members of the household to share and exchange income and expense information with one another for free, allowing families to work within a single household budget. The app can also be used to monitor your credit and debit accounts, as well as to categorize each household expense and set a budget for each. HomeBudget also allows you to add photos to an entry, such as receipts, and resize them according to your mobile device’s screen size.